A guide to as to the reasons, when, and how to re-finance your home loan

Alter try lingering. After you created the financial in the first place, the eye costs was indeed appropriate towards housing industry from the date. Concurrently, the shape and label of your own mortgage are compatible into money and you may outgoings at the time. You’d a different sort of family, numerous lay-upwards costs and you can was indeed merely looking your own feet towards property ladder.

Much might have altered subsequently. Maybe you acquired a top purchasing employment, had to need outstanding exit otherwise offered your family? Perchance you have to funds reily? Or possibly you’ve seen an incredible render regarding yet another financial that you can’t skip?

You’ll find several activities that may has changed, thus looking at your home loan on the idea of refinancing facilitate your financing to improve as you create.

What’s mortgage refinancing?

Refinancing your mortgage is not simply modifying the rate towards your existing loan. Is in reality paying down your home loan and taking right out a totally another one with different (we hope most readily useful) terms. You either manage your lender or switch to a beneficial brand new one any type of has got the finest deal.

Mortgage refinancing often is mistaken for almost every other mortgage alter, such as refixing and you may restructuring. Refixing involves trapping another interest having a particular time frame. Restructuring is mostly about looking at how your existing financial functions, then tweaking it for the situations. Particularly, you could potentially disperse between drifting and you will repaired, or you could regarding-lay the borrowed funds facing your offers or informal account.

Why you need to re-finance their financial?

Comparing should it be very theraputic for you to definitely refinance their mortgage takes hard work. There’ll be fees on it and you will behavior and make. So, exactly what points you’ll keep you motivated to begin with this process?

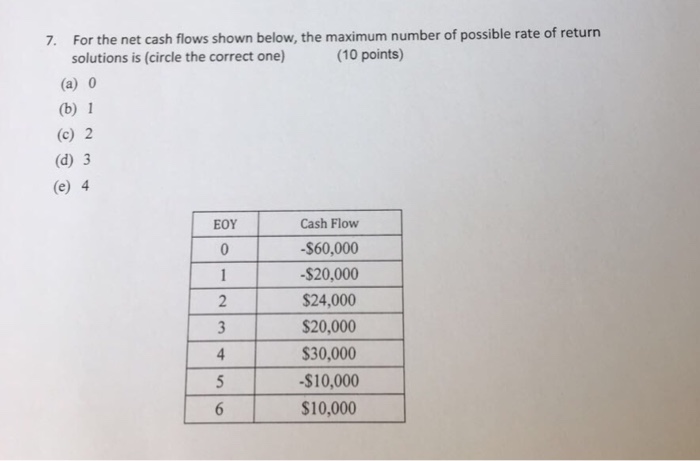

One to reason is that lenders’ interest rates are continuously switching, as a result toward money business. Remaining a near attention toward speed change oneself otherwise dealing with an advisor can save you thousands of dollars. You will find on the internet financial calculators which you can use examine your current mortgage (interest levels, label and cost) to alternative works together almost every other lenders. Such hand calculators can help you to understand the economic gurus you you may gain from refinancing.

Addititionally there is an unlimited quantity of other factors and you may items your can find on your own within the, which can make you think about refinancing. Your financial is set in order to a normal amount that you are essential to pay, from the predefined cost, to own a set period of time. You’ll be able to which cost matter are cramping your style or just while making lifetime unhappy. Or you could should release particular guarantee, being boost otherwise enlarge the house or property. Below are a few samples of if the brand new factors you are going to motivate that find a different sort of bank.

Your repayments are no longer reasonable

Maybe you destroyed your work, got separated, had a baby, covered degree, had sick otherwise took outstanding log off to care for children member. For various reasons, your income could have gone down or your expenses may have increased, otherwise both. You can no longer pay the regular money you authorized so you’re able to. Refinancing otherwise reorganizing you’ll provide the choice to get a beneficial top price or make smaller payments more than longer off time.

Newborns along the way

Dan and you will Georgia were not planning to initiate a family group having an effective number of years, however, existence tossed them a curve ball. They have twins due for monthly installment loans Arkansas the six months in fact it is gonna set an opening inside their earnings. Very first, Georgia’s gonna take annually off really works. Next, these are typically one another aspiring to dump its days, so that they can perform a good amount of energetic co-parenting. The 1950s create-upwards is only half-done up-and its fifteen-year mortgage title grew to become appearing like a major difficulty. Of the refinancing, it desire to compress their money and you can 100 % free-up some funds to do essential baby-inspired renovations. Dan and you may Georgia don’t have a lot of returning to starting all of the figures, thus they’re working with a large financial company for the best-circumstances scenario in their mind.