Rochester People Development Cut-off Offer (CDBG) Rehabilitation Program

The three programs here offer investment to reduce-money home and also make improvements on the design of house it individual and entertain:

OCHRA Homes Rehabilitation Financing System

The fresh Olmsted State Casing & Redevelopment Expert (OCHRA) has actually technically revealed this new Housing Rehab System. This method can give financial assistance to being qualified reduced and you may average-income homeowners to assist in keeping, restoring, and you may increasing the safeguards, livability, and effort results of its home.

Having loans available with the brand new OCHRA, the fresh new Casing Treatment system deliver two types of assistance readily available into an initial-been, first-served base to help you qualifying houses:

- Treatment Financing: Rehab Mortgage fund can be used to right risky conditions and you will password abuses, get rid of protection risks, repair or replace biggest solutions, best indoor or additional inadequacies, opportunity advancements, changes to possess individuals having handicaps and you will beat head-created paint perils. Minimal amount borrowed are $5,000. The absolute most offered try $twenty-five,000. Fund feature mortgage loan away from 2%, even if zero concept or attention repayments are manufactured till the house is available.

- Use of Financing: Usage of Financing money are used for this new removal of architectural traps as well as the installation of special gadgets and you will appliances to own truly disabled or more mature residents. Allowable installations and fixes tend to be but they are not restricted on framework away from ramps, customization out-of doorways, decline in sinks, lavatories, cabinets, installation of unique faucets, doorknobs, changes, and you can laying out handrails. There’s no minimal number. The most amount borrowed readily available is $5,000. Entry to funds is actually forgiven over a great seven-season months sufficient reason for a no % interest rate.

Are qualified to receive guidelines, your property has to be situated in Olmsted County (take note, residential property situated in Stewartville, aren’t qualified) and you should have had your house for at least six (6) days in advance of researching recommendations. You should be newest on your own financial as well as in this new percentage of the home/property fees. Simultaneously, you can’t surpass the household money restrictions given below:

MHFA Treatment System

The brand new Minnesota Houses Financing Agency’s (MHFA) Rehab Loan system facilitate lowest so you’re able to modest-income people in financial support renovations you to definitely yourself impact the defense, habitability, energy efficiency, and you can usage of of their land.

Eligible individuals must occupy your house become rehabilitated. Applicants’ property should not meet or exceed $25,000. Rehab Loan System income limits are derived from federal median family unit members money estimates and determined from the 31% of one’s Minneapolis/St. Paul urban area average income. The income limit having 2018 is actually $28,three hundred to have children of four.

The most loan amount is actually $27,000 that have a 15-year title, and you may 10-age having cellular/were created house taxed because individual assets. Mortgage fee are forgiven if for example the residence is not offered otherwise directed, and you may stays filled, in the mortgage label.

Really advancements for the livability, entry to, or energy savings from a home are eligible. Electricity wiring, an alternate rooftop, plumbing work, and you may septic fixes just some of the number of choices.

This choice helps lower in order to average-earnings home owners located in the mark area with capital renovations one to privately affect the defense, habitability, energy efficiency, and you will accessibility of its belongings.

The newest financing are notice-100 % free. The most loan amount was $twenty five,000 mortgage maximum that have dos% focus. The loan are paid down when the borrower carries, transmits identity, if any lengthened lives in the property.

Really developments towards livability, usage of, otherwise energy savings of a house meet the requirements. Electricity wiring, a different sort of roof, and plumbing work are just some of the possibilities.

Candidates eligible for this choice have to entertain our home is rehabilitated. Applicants’ assets cannot go beyond $25,000. The new qualified Modified Disgusting Yearly House Money Maximum for a treatment Mortgage is dependent on how big is the family. Your family earnings limits are prepared by the U.S. Institution away from Homes & Urban Invention (HUD) and are also revised per year. Annual money do not meet or exceed the lower-money limitations put of the HUD’s Houses Solutions Discount System. Money constraints have decided by level of individuals when you look at the for each home.

The Rochester Urban area Council possess assigned approximately $250,000 of the Community Creativity Cut off Give money to that program annually. This program normally advances 10-twelve home annually. There’s constantly a waiting list for it program. Fund are often allocated regarding slide and tend to be offered the new after the spring. Usually the rehabilitation performs starts in the summer.

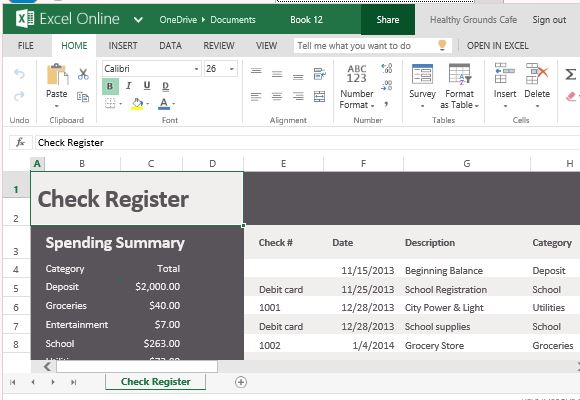

Earnings restrictions for 2020 HRA Rehabilitation Financing System

***Note: payday loan Inglenook Up-date tables in CDBG agreements and you will Part step 3 putting in a bid versions sent 09-03-20 so you can Luke Tessum, Area Domestic Treatment System