Previous Condition so you’re able to Virtual assistant Financing Anyone Should be aware

This past year try a fascinating season; to your COVID-19 pandemic therefore the presidential election, everything you appeared quite additional. But not, perhaps not exactly what taken place a year ago try bad, into the earlier seasons bringing certain significant reputation so you’re able to Va household finance, with since the somewhat enhanced their incorporate. Predicated on latest studies, the employment of Va funds improved because of the eleven.4% of 2019 so you’re able to 2020, getting a maximum of over 1.2 billion loans guaranteed in one single season on account of these transform.

Finalized with the rules towards , of the You.S. President, the fresh Bluewater Navy Operate has had some extreme changes on Va loan program. This new Light Domestic passed the latest act planning to compensate Vietnam Combat Pros whom had exposed to harmful chemicals in their deployment. Legislation including changed two tall areas of this new Virtual assistant mortgage system of the changing the Virtual assistant mortgage financing commission in addition to VA’s loan restrictions.

Alter towards the Financing Fee

The latest Virtual assistant financing percentage, a-one-date commission one Virtual assistant mortgage individuals have to pay on the financing, is actually temporarily changed. The alteration managed to get to ensure that Active Obligations Services Members pay an increased financing payment out-of 0.30%, and this in earlier times was at 0.15%. Members of new National Shield and you can people in the fresh new reserves, simultaneously, are in fact investing a reduced count on the resource fees. Yet not, these types of changes was short term and are believed to continue for within minimum the following 24 months.

Effective Responsibility Provider People who’ve a yellow cardiovascular system may have its financial support commission removed if they romantic their home whilst in a dynamic-obligations reputation. Also, veterans having disabilities have been currently exempt away from paying the money payment did not look for any transform on the financial support percentage payment criteria.

Removal of this new Virtual assistant Financial Restriction In past times, consumers exactly who applied for a good Virtual assistant loan had to endure Va condition mortgage limits, hence ranged for every single condition. That is not the way it is since the Virtual assistant entirely got rid of these types of loan limit criteria having basic-day Virtual assistant mortgage individuals. For this reason, Va financial recipients actually installment loans, Houston have the opportunity to live in alot more affluent communities, in the past unaffordable considering the Virtual assistant loan restrictions.

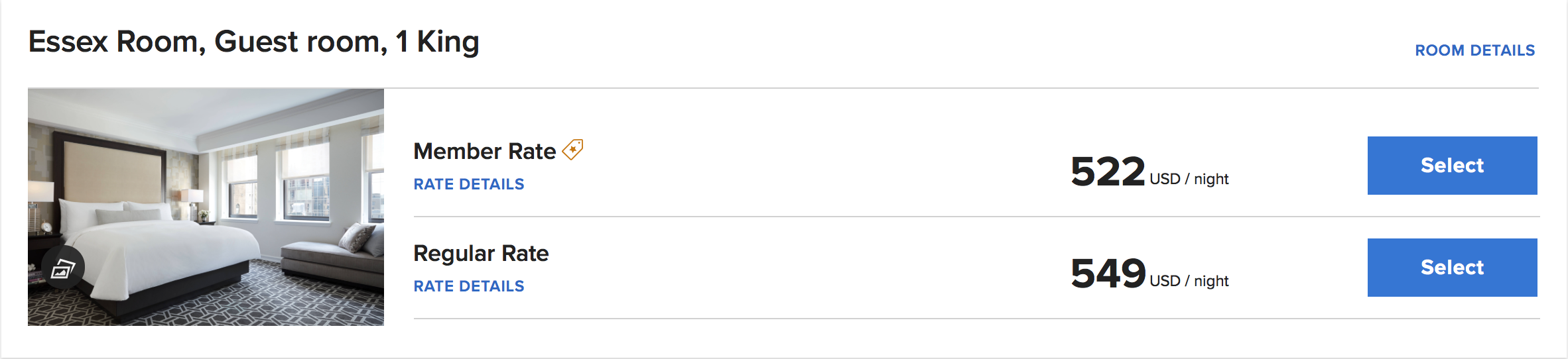

People exactly who have an effective Va loan and want to just take out the second that are still susceptible to its condition Virtual assistant loan maximum, and that an average of, since 2021, provides a limit out of $548,250, that can are very different each condition.

It is critical to observe that whilst the financing limit treatment lets lenders so you’re able to give out way more, it doesn’t mean that loan providers wouldn’t limitation how much cash you can be use. Given that loans are offered out-by lenders and not the fresh new Va, indeed there can nevertheless be restrictions in for how much cash you could obtain. Currently, Virtual assistant Mortgage Stores keeps a loan limitation off $5,000,000 to own earliest-go out Va mortgage individuals.

Indigenous Western Veterans just who get a beneficial Va financial and want to purchase a property into the Government Trust Belongings not suffer from loan maximum criteria.

What is a beneficial Va Home loan?

Often recognized as one of the greatest government-protected lenders available, Virtual assistant lenders offer numerous extreme pros. They are no deposit criteria, zero mortgage premium, low-interest levels, reduced monthly premiums, and you will repaired mortgages, and this last ranging from fifteen to thirty years.

Including, this new You.S. Government guarantees these types of money, offering loan providers shelter in the event the consumers do not want while making their monthly mortgage repayments and wind up defaulting. Which, lenders be a little more easy along with their application conditions and they are happy to work with candidates which have a reduced credit history.

Completion

The new signing of the Bluewater Navy Operate has brought transform so you’re able to the fresh new Virtual assistant home loan system. This type of changes increased the degree of houses opportunities in regards to our courageous men inside uniform. The law advances a currently excellent authorities financing program because of the strengthening borrowers with the removal of Virtual assistant financing limitations.

Phil Georgiades is the Official Local rental Pro getting Va Mortgage Facilities, a federal government-sponsored broker specializing in Va Lenders. He’s been already a real estate agent having 22 many years. To try to get a good Virtual assistant loan, contact us within (877) 432-5626.

Do you have questions regarding your credit history? If you’d like to speak with one of our attorneys or credit advisors and you may complete a totally free visit delight provide Borrowing Legislation Cardiovascular system an in step 1-800-994-3070 we could possibly love the opportunity to assist.

While you are looking to argument and you may manage the borrowing from the bank writeup on your, here is a link giving you with some facts on exactly how to go about Do-it-yourself Borrowing Repair.