The newest calculator endnote and you can disclosure claim that efficiency are different that have financial, geographic location, and prevailing interest levels

In general, the latest earlier youre therefore the significantly more security you’ve got when you look at the your residence, the greater the borrowed funds will be.

“Instead of getting rid of expense, spending money on medical care otherwise layer daily living costs, you can also explore an opposing financial to shop for a special domestic you to top serves your position. The advantage of using HECM for sale is the fact that this new home is ordered outright, using money from the fresh business of one’s dated house, private coupons, provide money or other types of earnings, which are up coming along with the reverse financial continues. Which real estate processes leaves you without month-to-month home loan repayments.”

FHA HECM Counselor training tips guide

A helpful reference to the specifics of the applying ‘s the counselor training guidelines “Addition to help you House Equity Conversion Mortgages (HECM)” of the NeighborWorks Training Institute.

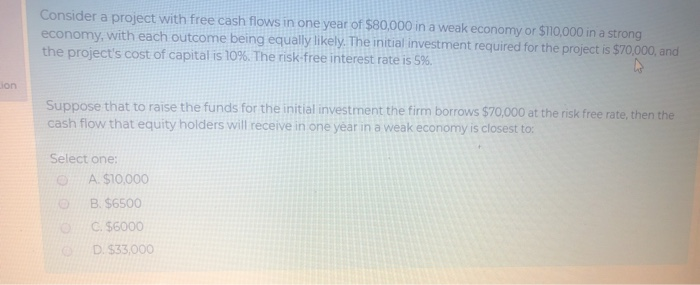

FHA HECM Opposite home loan calculator

Brand new type in and you can productivity forms with the Federal Opposite Mortgage lenders Association (NRMLA) calculator receive less than (click on a photo having full-size). Decide to try times was basically run in 2016 having

- an effective $2 hundred,000 house

- from the Midwest

- and no mortgage, and you may

- people who own an equivalent decades, to own various many years.

Typically, new “web mortgage maximum” (limit financing immediately after costs) and you will number available in the initial 12 months improved with age, while you are rates of interest was basically lingering. But if you need any home worthy of, you will need to promote.

New data in this post try rates only. These types of rates are derived from rates to your month of , which could otherwise might not be relevant to a loan to own that you could meet the requirements. This type of rates are not a deal to make you that loan, do not qualify you to see a loan, and tend to be not a proper loan disclosure. Rates, fees and will set you back vary from bank-to-bank. Only a prescription financial normally influence eligibility for a loan otherwise give an effective Good faith Imagine off mortgage terminology.

Please note: This calculator exists getting illustrative objectives simply. Its designed to give pages a general thought of calculate will cost you, charges and offered mortgage proceeds underneath the FHA Domestic Equity Sales Financial (HECM) program. Brand new costs and you will charge found commonly the real cost your might be offered by the people form of lender, however, essentially portray rates which can be available for sale today, towards limitation origination fee allowable around HUD laws and regulations reflected to have illustrative purposes simply, as well as an estimated FHA Mortgage Advanced for a loan based upon the house worth considering, and you may projected recording costs and you may taxation, or other brand of closing costs normally from the an opposite home loan. Notice these closing costs can and would are different by local area or region.

Lenders may possibly give different options into interest rates and you may fees. Interest levels for the adjustable rates HECM funds are composed out-of a couple components, a list and you can a great margin. The newest “index” (all of our calculator spends the latest Month-to-month Adjusted LIBOR, that is a familiar index included in the marketplace) usually to evolve continuously, as the field rates go up or down.

The lender could add an excellent “margin” with the list to select the interest rate indeed are energized. The latest margin utilized in our calculator is 250 cashadvancecompass.com debt consolidation for secured installment loans base situations (2.50%). You will probably find reverse home loan originators that provide higher or straight down margins and differing credit into bank fees or closing costs. Through to choosing a lender and you can obtaining a great HECM, the consumer will get about financing originator additional required cost regarding borrowing disclosures delivering after that factors of can cost you and you may terms and conditions of one’s contrary mortgage loans given by one originator and you can/or chosen from the individual. New Federal Contrary Mortgage lenders Association (NRMLA) is not an authorized lender or representative and does not create otherwise render loans. You will find a list of the financial people of the clicking here.