All you need to Realize about USDA Funds When selecting a beneficial Domestic into the Northwest Arkansas

When you think about the You Agencies regarding Farming (USDA), you really contemplate food safety and you will chicken-operating bush checks. But are you aware the USDA is also in the market off mortgage brokers? Yep, this new USDA also has as the goal to greatly help family into the outlying parts become property owners to form solid groups and you will greatest existence. So they really render mortgage brokers to help you low- so you can average-earnings families in the high cost in accordance with no down-commission criteria. Should you want to utilize this opportunity, some tips about what you must know about USDA financing when selecting property from inside the Northwest Arkansas.

Overview of USDA Funds

If you’re considering bringing a great USDA financing for selecting a property in the Northwest Arkansas, you will need to know what its and you can a little of your interesting records.

Good USDA mortgage is a government-supported, no money off mortgage having authorities-helped financial costs, and that means you get down costs than just with similar regulators-supported software instance FHA and you will Va. Since USDA funds do not require a deposit, you can acquire as little otherwise up to you prefer to order property so long as you to residence is during the a beneficial rural,’ otherwise smaller heavily inhabited, area.

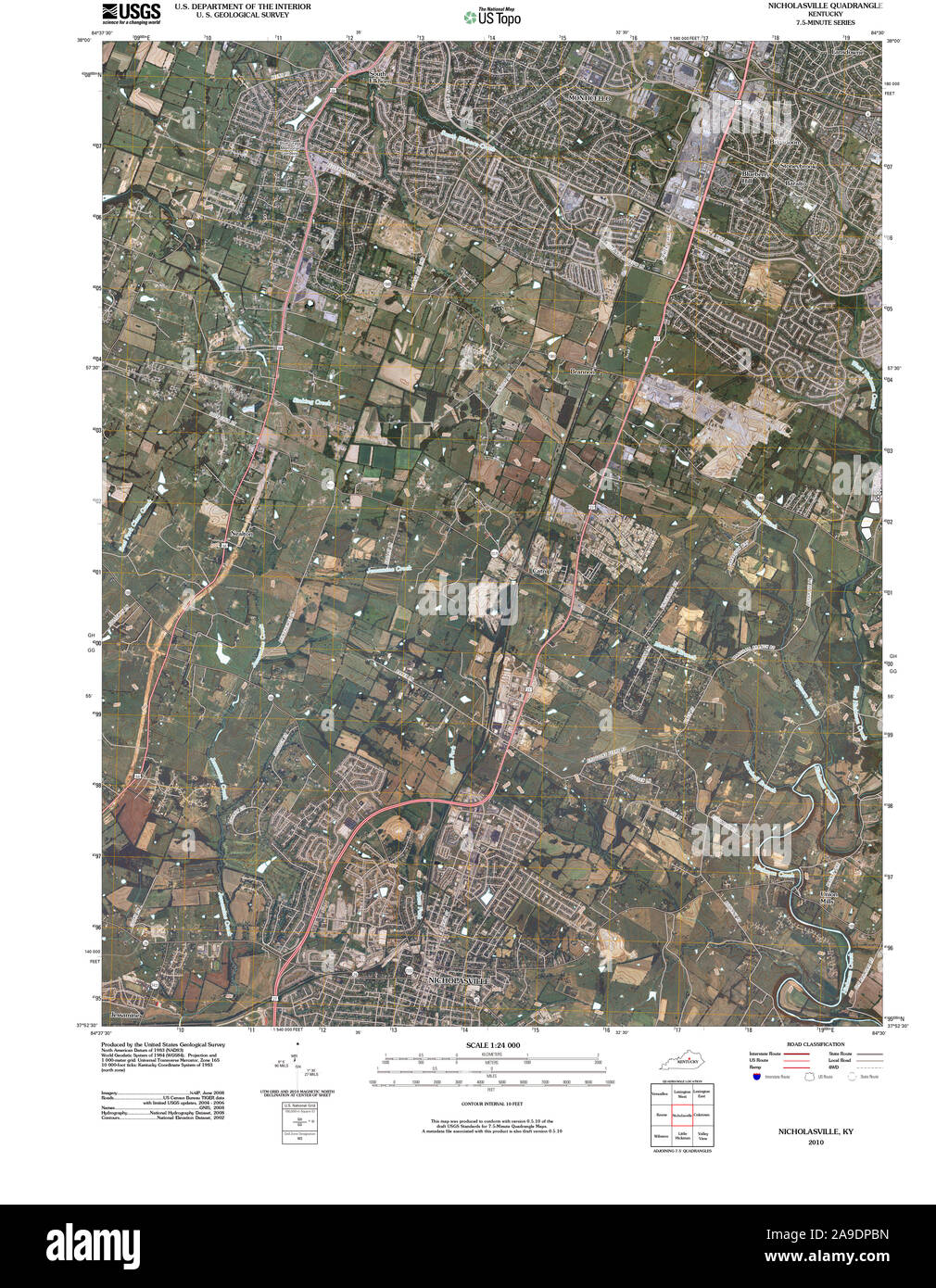

Today, rural doesn’t necessarily imply a ranch otherwise farm solution about center off no place. Rather, in this instance, [r]ural portion might range from the outskirts out of city, an area with many farmland, or a suburb off a huge urban area – very anywhere that isn’t noticed urban.’

USDA loans got its begin in 1949 when casing was a student in quick also have and you will many people was indeed forced to express home just after World war ii. Accepting that homeownership you may make teams and create perform (and additionally income tax money), the newest USDA observed the fresh new Western Homes Operate, and this lead to the construction out of many new land.

However, people had to be capable purchase such many new land. And so the government-recognized USDA loan program was developed.

USDA Financing Requirements

- Venue If for example the area you might be to order a home when you look at the possess under ten,000 customers, your property would be to meet the USDA definition of a rural city.’ Unincorporated portion and additionally meet the requirements. Certain municipalities that have to 20,000 people will qualify for USDA capital.

- Income Become eligible, you truly need to have a household earnings below the USDA restrictions to have the town. The new limit try 115% of one’s area’s average money. If the area’s average earnings is actually $50,000, you can not earn significantly more than simply $57,five hundred.

- Assets USDA loans are having no. 1 houses merely (regardless if this can include the brand new were created house).

Being qualified Conditions

- A credit score of at least 640 (that is a bit higher than you to needed for antique finance from the 620)

- A personal debt-to-earnings ratio (DTI) out-of only about 41% (that’s a tiny stricter compared to the DTI needed for really antique financing and you will indeed FHA financing)

- A provable number with a minimum of 2 yrs out of steady work

Fortunately, then, is the fact [i]f your satisfy all of those requirements and when your residence cost doesn’t go beyond the fresh house’s appraised really worth you could find the home with no money off.

Means of To get property With a good USDA Financing

- Pre-approval The fresh new pre-approval procedure reveals how the job would manage during the a bona fide underwriting techniques. You are getting sensible about your finances and you may monthly commission proportions rather than and come up with one commitments.

- Seeking an eligible domestic Usually, an eligible home could be an individual-home for the a community otherwise area which have a population from 20,000 otherwise less than or even in an unincorporated city. (To make certain our home you are interested in qualifies, consult a Northwest Arkansas broker during the (479) 777-3379.)

- Application for the loan Immediately after taking pre-approved, trying to find a qualifying domestic, and you may to make a deal, your upcoming step was to try to get the brand new USDA rural creativity package.

We’re Here to help

The good thing about to purchase a property americash loans Greens Farms with this specific form of loan is the fact that the USDA claims your mortgage towards lender. Like that, their bank understands that their percentage gets produced. This provides you with all the way down risk towards financial, allowing them to bring straight down interest rates without downpayment. The problem is dependent on the newest some stricter lending conditions and the pretty narrow assets-qualifying requirements. However, our company is right here to simply help.

You will find knowledgeable agents that will help you find being qualified home and you can guide you from the processes. If you are looking from the to buy a property within the Northwest Arkansas and you may are planning on an effective USDA financing, contact us today within (479) 777-3379.