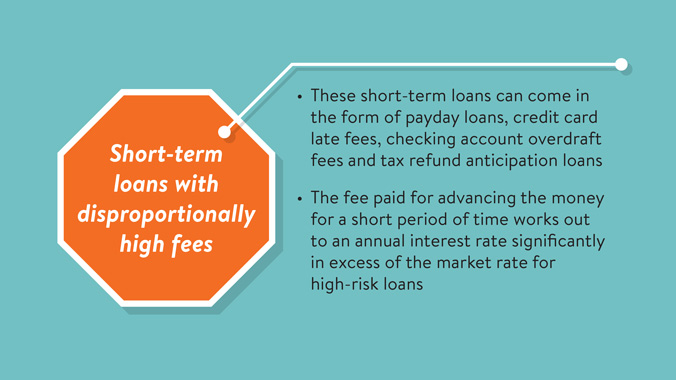

The financing is actually nonrefundable, therefore the borrowing from the bank matter you can get are unable to surpass the total amount your are obligated to pay during the tax

Far more When you look at the Credits & Write-offs

If you invest in renewable energy for your house including solar, snap, geothermal, power cells otherwise electric battery storage tech, you can even qualify for a yearly residential brush opportunity income tax credit.

On this page

- Exactly who qualifies

- Qualified costs

- Qualified brush energy property

- How-to claim the financing

- Relevant information

The way it works

The Domestic Clean Energy Borrowing translates to 29% of one’s will set you back of new, accredited brush opportunity possessions for your house hung each time off 2022 because of 2032. The credit payment rate phase down seriously to twenty six per cent having possessions listed in solution during the 2033 and 22 percent to possess possessions put operating in the 2034. You will be able to take the borrowing if you generated energy saving developments to your residence located in the All of us.

You might carry forward any excessive empty borrowing from the bank, even when, and implement they to reduce the fresh income tax you owe in future ages. Dont were attract paid back together with loan origination costs.

The financing doesn’t have annual otherwise life buck limit with the exception of credit limits to own stamina cell assets. You could claim the fresh new yearly borrowing from the bank each year which you setup eligible assets up until the borrowing from the bank begins to stage call at 2033.

Borrowing constraints to own electricity cellphone property

Fuel cell house is limited by $500 per half kilowatt out-of skill. If the several person resides in our home, this new shared borrowing from the bank for all customers cannot exceed $step 1,667 for each 1 / 2 of kilowatt from power telephone skill.

Just who qualifies

You could allege the newest domestic clean opportunity borrowing from the bank for improvements to most of your home, whether you own otherwise lease they. Your main home is generally your area every big date. The financing applies to the fresh otherwise established house found in the United states.

You might be capable allege a card for sure developments designed to a moment home found in the Us one you live in region-some time try not to lease so you can anyone else. You can not allege a card having stamina cellphone assets to own a great second home or for a property that isn’t based in the united states. Pick regarding being qualified residences.

Organization entry to family

If you utilize your home partly to have organization, the utmost available credit for qualified brush times expenditures is as follows:

- Business account for in order to 20%: complete credit

- Team fool around with more 20%: borrowing from the bank considering share away from costs allocable to help you nonbusiness use

Licensed expenditures

- Solar power electric panels

- Solar power hot-water heaters

Certified expenditures start around labor prices for on-site planning, set up or fresh having the property as well as for plumbing or cables in order to connect they on home.

Antique building areas you to generally serve a roofing system otherwise architectural setting basically don’t meet the requirements. Particularly, roof trusses and you will conventional shingles one to assistance solar power systems try not to meet the requirements, however, solar power roofing ceramic tiles and you can solar power shingles create while they build brush time.

Subsidies, rebates and you will bonuses

When figuring their borrowing, you may need to deduct subsidies, rebates or any other economic incentives from the licensed possessions costs because they might be experienced a purchase-rates changes.

Public-utility subsidies for buying otherwise setting up clean opportunity property is deducted off accredited costs. That is true if the installment loans Utah subsidy arrives directly to you or so you’re able to a specialist on your behalf. But not, energy money having clean opportunity you offer back once again to the newest grid, such as for example internet metering credit, dont affect your own certified costs.

State energy savings bonuses usually are not subtracted of licensed costs except if they be considered because the a rebate or buy-rates adjustment under government tax rules. Of numerous claims label energy efficiency incentives because the rebates while they dont meet the requirements lower than one meaning. Those incentives would be included in your own revenues getting federal tax objectives. Come across about just how subsidies apply at home times credits.

Accredited clean opportunity assets

Solar hot-water heaters should be certified of the Solar Rating Certification Corporation otherwise a comparable entity endorsed by your state.

Simple tips to allege the credit

Document Means 5695, Residential Opportunity Credit together with your income tax go back to claim the financing. You should allege the financing on the tax seasons in the event that house is hung, not just purchased.