FHA Loans was paid from the regulators and supply an alternative make certain to loan providers

Once the 1934, the newest Federal Construction Management (FHA), that is a part of new Institution away from Houses and you will Urban Innovation (HUD), has been enabling some body get to the dream about homeownership. Through providing mortgage insurance one to protects loan providers in the example of standard, the deficiency of rigid certificates, and assisting that have down repayments and you will settlement costs, this new FHA could have been capable assist hundreds of thousands safer casing thanks to approved loan providers such as for instance united states.

Carrying out towards the , Brand new Government Homes Management (FHA) established it is providing DACA Visitors to be eligible for FHA Mortgages.

DACA people, called dreamers, are those that undocumented but were introduced towards You.S. before its 16th birthday and you can have been within the chronilogical age of 31 if group was created inside the 2012. Area Finance was thrilled to be an integral part of so it milestone in the business therefore we desire forward to providing because people once we is also.

These were before getting refused on account of wording from the FHA Houses guide one mentioned, Non-People in the us in place of lawful home regarding You.S. are not qualified to receive FHA-insured mortgage loans. The word legal house pre-schedules DACA and thus don’t enjoy a position in which a debtor might not have joined the nation legally, but nevertheless meet the requirements lawfully introduce. In the years ahead, truth be told there shouldn’t be one points with respect to legal abode to possess DACA consumers trying to safer financing.

Why does a keen FHA Loan Really works?

When the a keen FHA Debtor non-payments otherwise does not pay back the loan, the new FHA often refund the lender on leftover dominating towards the the house. That it be sure allows lenders to offer enticing financial conditions to people that are trying to safer money with a tiny down payment or mediocre credit history.

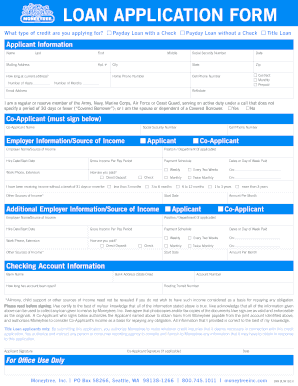

In addition to this book ability, the fresh FHA financing procedure will be the just like every other home mortgage. You are going to use and possess pre-accepted, select property, offered most of the vital information and you can documents towards the bank, perform some last monitors, and you will signal most of the closure data.

Advantages of FHA Mortgage Apps

Typically the most popular need to safe capital having a keen FHA financial ‘s the low-down payment requirementpared so you can a traditional home loan that requires good 20% deposit, FHA mortgages only need at least downpayment out-of step three.5%! It opens up the doors off homeownership to several of them which is reluctant to exhaust the discounts to possess a downpayment.

When you are talking about a number of loans, like student education loans, don’t get worried you could nonetheless secure funding that have an FHA Financing. That have FHA applications, your credit score is dictate the minimum down-payment amount, nevertheless https://paydayloancalifornia.net/sun-village/ won’t be greater than ten% having substandard scores. The financing get requirements will vary according to the lender you are working having however these apps are created to approve borrowers which have the common credit score.

Personal Financial Insurance

When you build a downpayment below 20%, you might be needed to provides Personal Home loan Insurance policies (PMI) at the top of your own normal homeowners’ insurance rates. PMI funds are acclimatized to supply the financial a promise during the situation a borrower defaults. PMI might be factored into your payment and certainly will vary in cost in accordance with the value of your home. It has to even be similar in expense for the regular homeowners’ rules.

Remember, the brand new PMI connected to your own mortgage might be terminated when your loan-to-worth ratio are at 80%. Once you build 20% collateral of your house, you can contact the lending company otherwise solution of financing to help you obtain it terminated.

Rates of interest

To discover the best FHA interest rate, you will need to look and contrast lenders observe who could offer a decreased. Rates is vary each day and is also crucial that you continue discover correspondence together with your loan officer to get locked for the during the the lowest speed.

FHA rates of interest are dependent on a few private factors, like your credit history, debt-to-earnings ratio, and downpayment amount.

As the an FHA approved lender, People Finance it’s thinks into the homeownership for everyone. We are motivated by being capable of making all of our clients’ aspirations come true. For those who have any questions on eligibility otherwise would like to start the new homebuying procedure, reach out to united states today!