How to become that loan Officer How to be that loan Administrator How to be a loan Administrator

Bring your Second Fearless Action

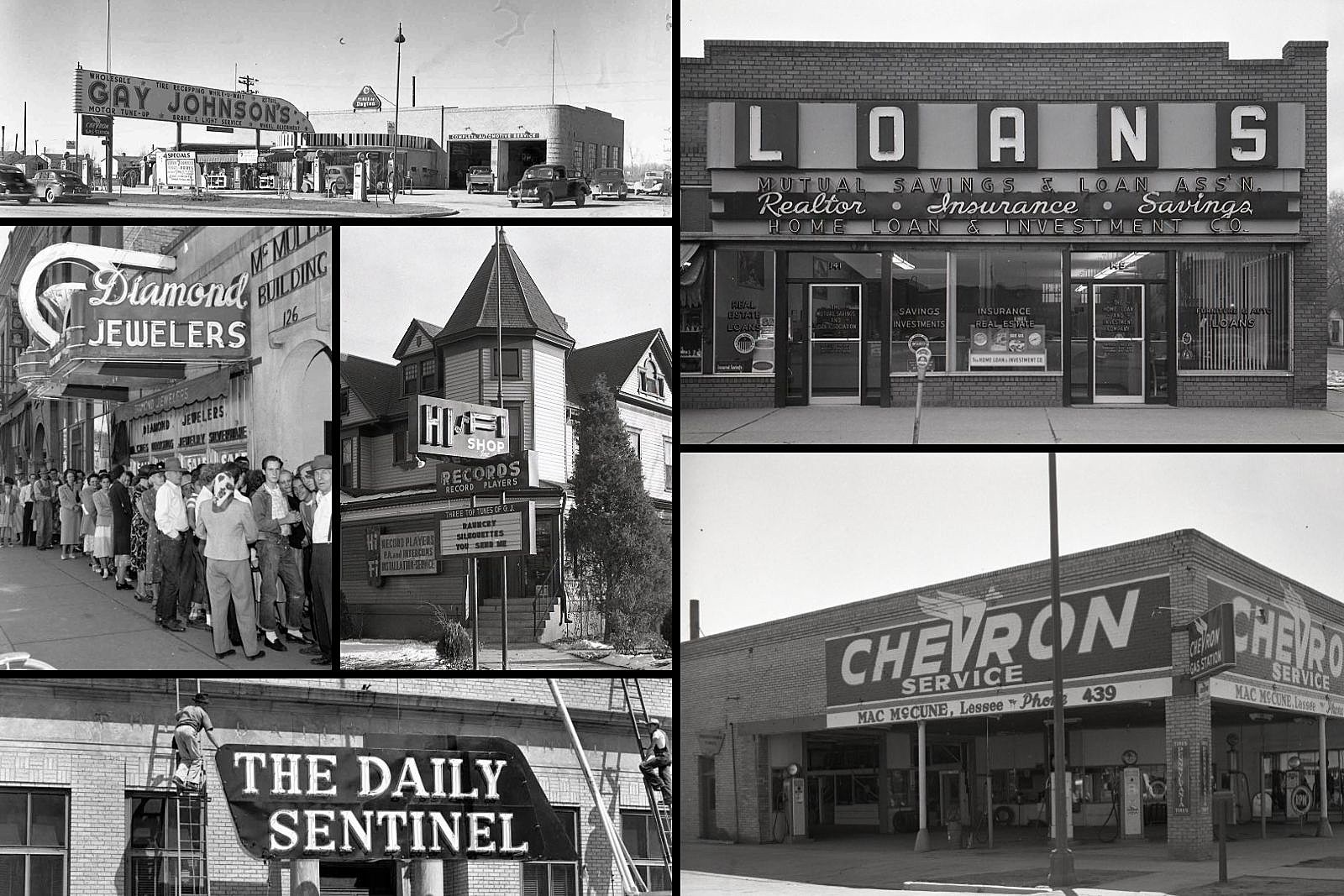

Some of life’s most crucial goals rely towards the delivering accepted to own a loan. Loan officers help anybody discover requirements they might has wanted their entire lives, instance to shop for property, investment a child’s training, or introducing a business. The work from mortgage officials involves underwriting finance for people and you may enterprises, potentially reshaping its futures. Individuals with strong interpersonal and you may company feel just who be motivated by the the chance to changes a business or create another person’s fantasy a real possibility is to understand how to end up being that loan administrator.

Precisely what does that loan Administrator Perform?

Loan officers glance at loan applications out-of anybody and you may organizations and you may measure mortgage demands and you can creditworthiness. Dependent on its authority, financing officers often often approve that loan or suggest its approval. The fresh new lending process concerns get together and confirming requisite financial files and you can after that determining should your pointers considering warrants the fresh new monetary risk of providing that loan. Of many creditors play with certified software you to supports loan officials inside the the decision-making.

Mortgage officers benefit creditors, such as for example banking institutions and you can credit unions. Its jobs handle handling the sorts of lending products their establishments bring. These materials you’ll is credit lines and differing sort of financing such as mortgages. Financing officials give consultations to their website subscribers regarding and that factors have a tendency to ideal see their requirements. Then they guide consumers from credit process. To take action, financing officers have to be really-acquainted its institution’s readily available lending options and then explain all of them. They should plus factor in the latest creditworthiness from possible borrowers when suggesting an item. In the long run, mortgage officials need to comprehend the principles and you can regulations governing the brand new financial community to ensure a properly carried out financing.

- After the leads having prospective borrowers

- Consulting with clients to get personal data and talk about financial loans

- Confirming the latest belongings in applications and determining funds to have recognition otherwise denial

- Ensuring fund follow state and federal regulations

- Industrial mortgage officers do loans, hence include large and much more state-of-the-art than other mortgage typesmercial loan officials have to learn commonly challenging economic items from businesses when designing decisions. They could and coordinate with other lending establishments when the more you to definitely bank is covering the complete amount of the money becoming requested.

- Personal bank loan officials create loans to people, which cover expenditures such as for example auto requests. It guide their customers from the financing processes, tend to playing with underwriting app, hence decides acceptance otherwise assertion away from simpler loans. Yet not, personal loan officers into the reduced banks otherwise credit unions you will dictate creditworthiness as opposed to underwriting application.

- Real estate loan officials create money utilized for domestic otherwise industrial genuine house. They might assist enterprises or anyone pick or re-finance attributes. Have a tendency to what they do pertains to obtaining providers from a residential property enterprises.

Methods in order to become that loan Administrator

People who have a desire for team and you can finance is get a hold of a good possibly fulfilling occupation road of the teaching themselves to getting that loan administrator. A mixture of ideal education and you may experience can cause achievement in the world of lending and you may financing.

1: Secure a good Bachelor’s Education

Very financial institutions want to get financing officers with acquired at the very least an effective bachelor’s studies. Loan officials constantly hold a beneficial bachelor’s knowledge from inside the money otherwise a good relevant field including company or bookkeeping. An effective bachelor’s degree inside the finance has the vital business and you can funds record a loan officers have to create its operate. New guides now offers courses one to broaden students’ comprehension of monetary accounting and administration and create communications enjoy related with the world of business. Groups together with illustrate strategies for logical tools strongly related to loan officials that can assist them evaluate and translate economic and accounting pointers.

2: Get Functions Feel

Along with a good bachelor’s training, earlier in the day works experience with banking, support service, or conversion process also provides job people a competitive virtue. Financing officers manage a great amount of files and manage logistics. Those individuals searching for getting mortgage officers should take part in works you to grows those feel. Financing officers including guide people by way of an often not familiar and you may potentially anxiety-producing processes. Prior functions experience that produces social event may also generate good loan officer popular with possible employers.

Step 3: For Certification (Optional)

While most loan officers commonly necessary to see licensure, of numerous acquire experience to enhance its credentials. Home loan officers, however, need to receive certification. An interest rate inventor installment loans in Indiana (MLO) license means 20 instances out-of training, profitable completion out of an exam, and submitting in order to history and you can borrowing from the bank inspections.

Several financial connections promote a lot more experience, for each using its very own standards. Constantly individuals need certainly to complete coursework and have now 36 months regarding functions experience. Holding like a certificate helps validate a loan officer’s skills in brand new financing team.

Mortgage Administrator Salaries

Financing officers’ wages variety broadly, to your base ten percent earning to $33,000 a-year plus the top 10 % making as much as $136,000 a-year, according to the U.S. Agency from Work Analytics (BLS). The fresh new average salary to have mortgage officers is actually $64,660 into the . Any of these advantages receive earnings for their really works, while some secure apartment wages.

Median wages getting loan officials from the better circles you to definitely apply are usually: $84,230 annually having loan officials who do work to have auto dealers, $68,740 just in case you work in company and you may agency government, and $63,420 for those with positions during the credit intermediation, depending on the BLS.

Coming Employment Growth having Loan Officers

The brand new BLS plans 11 percent work development to have mortgage officials of 2016 in order to 2026, hence compatible thirty six,3 hundred the fresh new efforts. Because the savings expands, organizations and other people will look for finance, ultimately causing an elevated number of efforts to own financing officers.

Start Their Trip Toward As that loan Officer

Now that you have read how to become a loan manager and what mortgage officers do, make first step toward this rewarding occupation by examining Maryville University’s on the internet bachelor’s during the financing to find out more about what it needs to progress because the financing officer.

Getting Daring

Promote us your own aspiration and we will assist you together a personalized road to a quality knowledge which is designed to change your existence.