How to get credit since a-stay-at-family mother or father

To get a grandfather is an emotional, overwhelming and you may fascinating amount of time in everything. There is certainly much to arrange for and will also be juggling of numerous different jobs, and caregiver and you will seller. If or not you decide to be a stay-at-family father or mother, or it becomes your best option available through the specific season from existence, you’re questioning how to continue to care for and you can build your borrowing from the bank.

When you are performing area-time to make money is an alternative-such as versatile remote work-it is far from fundamentally achievable for everybody, particularly that have an infant. In this article, you will observe throughout the certain ways you can always make borrowing from the bank because the a stay-at-household parent.

An approach to create credit rather than a living

/wells-fargo-inv-9d5f3d4ec9424216b5c6ec7bf39bd356.png)

Due to the fact a special father or mother, there are lots of items you will have to give up, and of course, such which you’ll get-however, your borrowing from the bank doesn’t have to be http://availableloan.net/installment-loans-oh/hudson one of the points that suffers. Here are some ways you can continue steadily to build borrowing just like the a stay-at-domestic mother or father in the place of a full time income.

Feel an authorized associate

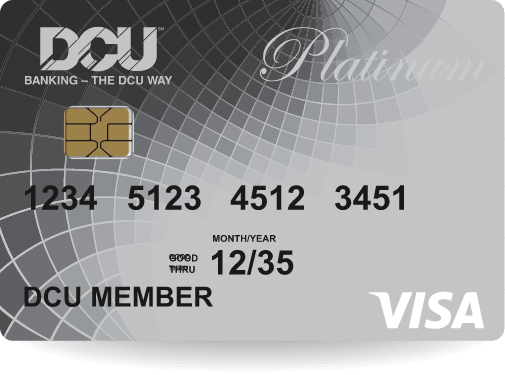

One-way you might continue steadily to build credit as a-stay-at-family mother or father instead an income is to try to feel a third party user. Such as for instance, if your lover is performing, they may incorporate you as a 3rd party representative on the borrowing cards. This will will let you use the credit because if they was their. The main membership owner (in cases like this, your ex partner) would nevertheless be guilty of making the payments, but your title can also be towards the account and supply your with the opportunity to generate borrowing. Just how that it works is the fact that the credit rating of these card may be the credit history on your own credit history for as long since you will always be a 3rd party user.

Keep in mind if you find yourself weighing your options one, because the a 3rd party representative, your borrowing might go one of two indicates. It could improve your borrowing from the bank (in the event your number 1 credit proprietor is responsible that have making its monthly payments) or harm their borrowing (in the event the no. 1 card manager are reckless and you can defaults). Due to the fact a third party affiliate, the credit try influenced by an important card holder’s choices while the it applies to their borrowing, expenses and economic management.

Contemplate using suitable playing cards

Even if you do not have a reliable money, you can continue using your own handmade cards in ways one to help you. For example using handmade cards that provide benefits for situations eg food, fuel and you may restaurants. Which have raising students, you’ll positively be making reoccurring requests that could possibly add up to earn you advantages, savings or other experts.

These types of notes include shop credit cards (particular in order to a specific shop or strings regarding stores in this a good network) or playing cards that could have particular advantages otherwise down yearly payment cost (APRs).

Use totally free systems for example Pursue Credit Excursion to help you

Expecting function a lot of added expenses-you are probably aspiring to save your self will cost you preferably or was thinking how to keep the credit score amidst all the the fresh new expenditures. Contemplate using online tools instance Credit Travels to display and you can possibly improve your credit score. You can get a personalized bundle available with Experian so you’re able to get it done to change their get to make certain that its for the an excellent standing prior to and through the parenthood.

- Found a totally free, updated credit history as much once the all 7 days

- Display and you may tune your credit score over the years

- Enroll in borrowing overseeing and you can term keeping track of alerts to keep your data secure

- Leverage totally free informative resources to simply help greatest understand your credit rating

- Utilize the borrowing believed feature to map out the future credit history

Set resources or other attributes on your own label and pay them every month

Whether you are producing earnings away from another supply otherwise revealing your partner’s money to pay for expense, place bills and repeated bills beneath your term to create up your fee records and rehearse a charge card to blow them out of. However, ensure to help you funds meticulously for these sorts of repeating expenditures.

Fee records is actually a major factor that gets thought whenever figuring your credit rating. Gathering a stronger, consistent fee records can help you to build borrowing from the bank as the a stay-at-house parent. While you are while making your repayments punctually, this can be a very good way to simply help replace your borrowing rating over time.

Open a mutual account with your companion/lover

If the companion offers a source of income and you can takes away financing, consider having your term listed alongside theirs. Starting a mutual account with your companion (instance a car loan) might help broaden your accounts, that may alter your credit blend. This should help you gain trustworthiness on the attention regarding loan providers and help create a stronger credit rating through the years.

Building borrowing as just one father or mother yourself

If you find yourself an individual, stay-at-home-mother, may possibly not become possible to accomplish most of the over. You could believe considering any style of regulators masters which will apply at your.

If you are impact overloaded or perplexed, ensure that you reach out to the individuals whom love you to have help. Explore particular choice having friends up until the little one arrives very you will get an idea in position, such as for example that will assist watch your youngster as you functions.

In conclusion

Becoming a dad is an exciting time, and the last thing we should worry about because you get ready for parenthood ‘s the state of credit rating. You could avoid worrying regarding how your credit rating is doing by the getting proactive and you can diligent, causing you to be more hours to focus on she or he.